EXPORT PROCESSING CARGO

PROCESS PROCEDURES ESTABLISH NEW FACTORY AND CUSTOMS CLEARANCE FOR EXPORT PROCESSING CARGO

EXPORT PROCESSING CARGO

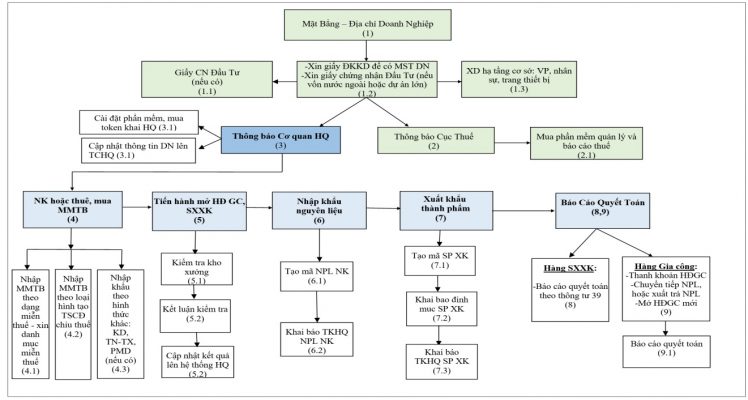

PREPARATION STEPS :

1. Inform to Customs Department:

Priority should be given to enterprises in industrial zones and export processing zones at their local branches

2. Digital signatures ( Token USB)

Buying Token USD and register the appropriate service packing

Profile enterprise must provide (certified copy or true copy) :

• 01 Copy of register digital signature using customs.

• 01 Copy of business license of enterprise.

• 01 Copy of tax code registration certificate.

• 01 Copy of ID card or passport of legal representative.

• 04 Copy of the commercial contract.

3. VNACSS software

Consult enterprise choose suitable type of import and export ( Business,Export production, Export processing)

Registration the contract with Thai Son software company.

Setup VNACSS software

Updating digital signature on the Customs system

4. Registration enterprise information

Updating enterprise information on General Customs system

Record tax code of enterprise on the system

Time to update : 24hours

Require : business license (copy scan)

IMPORT MACHINERY AND EQUIPMENT FOR FACTORY

|

|

|

|

|

|

1. Import machinery under tax exemption

- Registration list of tax exemption

- Import machinery and equipment

2. Import machinery under type of business to make fixed assets pay tax

Feature :

Enterprise don’t enough condition to get list of tax exemption

• Case of enterprise need to expand the factory

• Enterprises are subject to import duties

• Enterprise pay Vat tax (if any)

• Consulting applied HS code reasonably to benefit business

• Time: can be done right after completing the preparation steps

Importing Machinery equipment

Enterprise must provide documents as below :

• Invoice – 01 copy

• Packing list – 01 copy

• Bill of lading – 01 copy

• Import contract – 01 copy

• Referral letter – 03 original

• Business license -01 copy

REGISTRATION EXPORT PROCESSING CONTRACT

Checking warehouse/factory

Object :

Registration the export processing contract / export production contract at first time

• Enterprise receive outsourcing but hire other firms to process all / part

• More than 3 months after completing the import customs procedures for the first batch of raw materials but no have any products to export

• Random on the basis of risk management to assess the law compliance of the enterprise

Time :

After the enterprise submits the complete dossier of notification of export processing contract / export production contract

• Notification time to check warehouse/factory before 3 days

• Inspection agency: representative of the Customs Branch manages the export processing contract / export production contract

Checking content :

The right to use and lawful ownership of the factory’s facilities, machinery and equipment

Fence, security …

Ownership, right to use of machinery and equipment at the production facility compared to the declaration

– Import declaration (if imported)

– Invoices and vouchers for buying machines and equipment (if purchased in the country)

– Finance lease contract (if renting machines)

The situation of human resources processing / manufacturing

– Enterprises operating over 2 months: payroll, list of employees covered by insurance

– DN less than 2 months: may add later

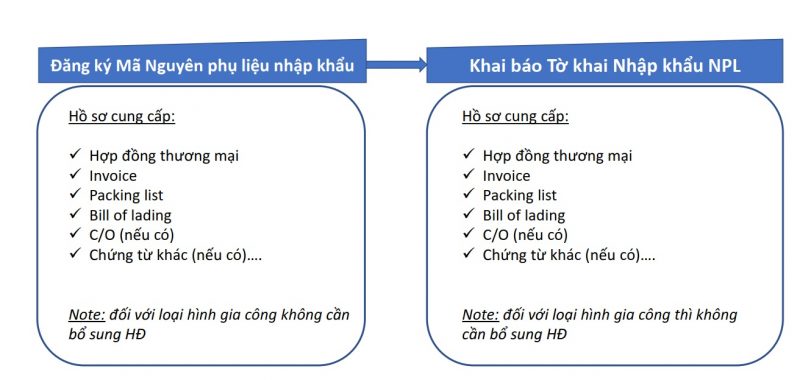

PROCESSING IMPORT RAW MATERIAL

Import raw material

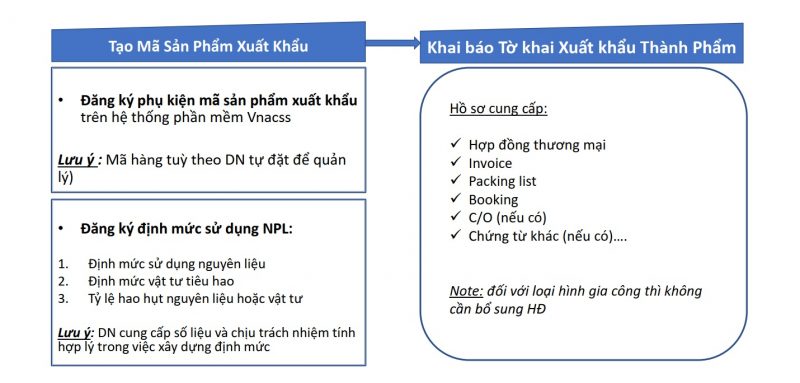

PROCESSING EXPORT THE FINAL PRODUCTS

Export the final products

FINAL REPORT (Circular 39)

TYPE OF EXPORT PROCESSING

Time: 30 days before the expiry date of the current processing contract

1. Open new the export processing contract => 2.Liquidation of current export processing contracts => 3. Handling excess raw materials and supplies; discarded materials, defective products, machineries and equipment rented or borrowed in service of processing in various forms :

– Selling in the Vietnamese market

– Export paid to foreign countries

– Switch to other processing contracts in Vietnam

– Presents and gifts in Vietnam

– Destroyed in Vietnam

=> 4.Transfer raw material to new processing contract or return raw material

Time: the 90th day from the end of the fiscal year at the latest

Annual settlement finalized report

According to the principle of total value of import – export – inventory of raw materials, supplies, semi-finished products, finished products

The finalized report must be consistent with the accounting vouchers of the organization or individual.

Tiếng Việt

Tiếng Việt