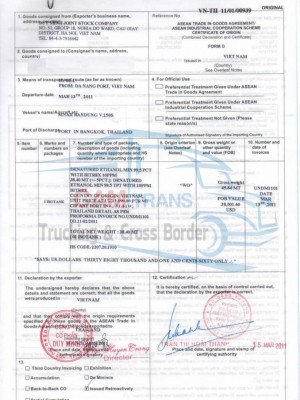

C/O Form D, short by Certificate of Origin, mean certificate letter original cargo export/import shipment. CO let us know original cargo which manufacture from where, which nation or area.

From that, Customs will specify cargo have enough standard import and get preferential tax or not. Import business enterprise has CO will save costing price. Increase competing capability and profit.

CO Form D applied all in nations in Asean.

TARIFFS UNDER THE ASEAN TRADE IN GOODS AGREEMENT ATIGA (CAMBODIA)

TARIFFS UNDER THE ASEAN TRADE IN GOODS AGREEMENT ATIGA (CAMBODIA)

Tiếng Việt

Tiếng Việt