Freight Rate Decline and Market Implications

Overview of Freight Rate Trends

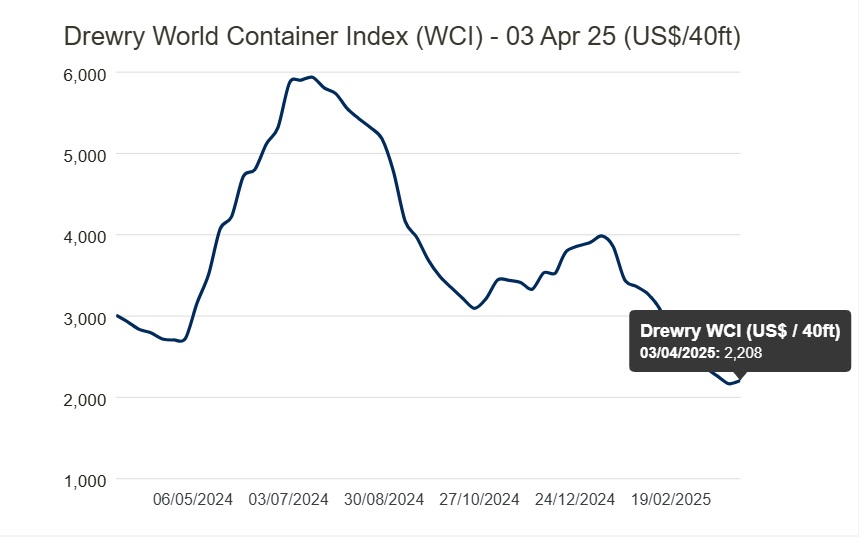

Between July 11, 2024 and March 20, 2025, the Drewry World Container Index — a benchmark for freight rates across the world’s eight major maritime routes — recorded a significant decrease of 61.6%, marking the lowest point in over a year.

This sharp decline in freight rates has compelled leading global container carriers to implement capacity reductions. Notably:

-

MSC has suspended the planned relaunch of the Mustang service.

-

The Premier and Ocean alliances have temporarily halted new trans-Pacific services and an Asia–Europe route.

| Time Period | Freight Rate (per 40ft container) | Change (%) |

|---|---|---|

| July 11, 2024 | USD 5,901 | – |

| March 20, 2025 | USD 2,208 | -61.6% |

Strategic Restructuring of Shipping Alliances

In response to evolving market dynamics, major shipping alliances have undertaken significant restructuring since February 2025, resulting in widespread changes in the global maritime landscape:

| Alliance Name | Member Lines | Status & Implications |

|---|---|---|

| Gemini Cooperation | Maersk, Hapag-Lloyd | Newly established alliance |

| Premier Alliance | HMM, ONE, Yang Ming | Newly established alliance |

| Ocean Alliance | CMA CGM, COSCO, Evergreen, OOCL | Continues operations |

These restructurings have:

-

Increased the number of service routes

-

Diversified service offerings across regions

-

Prioritized port calls at carrier-owned terminals, including deep-water ports in Asia and Vietnam

As a result, domestic Vietnamese shipping companies are now facing heightened competitive pressures.

Fleet Expansion Amid Uncertain Demand

According to Alphaliner, by early March 2025:

| Metric | Value | Notes |

|---|---|---|

| New vessel orders | 8.74 million TEUs | Represents 27.4% of total global fleet capacity |

| Forecasted fleet capacity (2025) | 32.9 million TEUs | Expected 5.8% year-on-year growth |

| Delivery trend | Rising in 2026–2027 | Due to deliveries from 2022–2023 orders |

These new orders are intended to support fleet modernization and meet future demand. However, supply growth is outpacing demand recovery.

Demand Outlook and Retail Inventory Insights

Despite rising fleet capacity, several indicators point to a potential decline in global cargo demand. Analysts from Goutai Junan Securities (Vietnam) highlight that:

-

U.S. retail inventory levels have risen sharply from early 2024 to March 2025.

-

This trend reflects both:

-

Optimism regarding a potential recovery in consumer demand, and

-

Stockpiling behavior ahead of the anticipated implementation of U.S. tariff policies under President Donald Trump.

-

Tiếng Việt

Tiếng Việt